Gold remains a beacon for investors in turbulent times, and with 2025 shaping up to be economically volatile, many are wondering: what will gold’s price be by year-end? From U.S.-China trade tensions to AI-driven disruptions and shifting interest rates, global forces are driving gold’s trajectory. Here’s a detailed look at what to expect for gold prices in 2025, with a glimpse into 2026 and 2027, based on current economic trends.

The Economic Scene in 2025

The global economy is navigating a complex landscape. In the U.S., President Trump’s policies—tariffs, tax cuts, and trade disputes with China—are raising inflation fears and weakening the dollar, both of which are bullish for gold. The Federal Reserve is likely to keep interest rates low, making gold, a non-yielding asset, more appealing than bonds or savings accounts.

China, a major gold buyer, is facing slower growth and a property crisis. Its central bank is stockpiling gold to diversify reserves amid U.S. tariff threats, while Chinese consumers are turning to gold as a safe haven. This demand is a key price driver.

AI and robotics are reshaping industries, sparking concerns about job losses and economic inequality. These shifts could fuel market volatility, pushing investors toward gold. Meanwhile, geopolitical risks—trade wars, conflicts in Ukraine or the Middle East—reinforce gold’s status as a hedge against uncertainty.

Why Gold Prices Move?

Gold thrives under specific conditions, many of which are active in 2025:

- Central Bank Demand: Countries like China are buying gold to hedge against sanctions and currency risks.

- Safe-Haven Appeal: Trade disputes and geopolitical tensions drive investors to gold.

- Low Interest Rates: With real yields low, gold’s lack of yield is less of a deterrent.

- Inflation and Dollar Weakness: Rising prices and a weaker U.S. dollar make gold a go-to hedge.

On the flip side, a booming U.S. economy or stock market could pull investment toward riskier assets. Unexpected Fed rate hikes or easing global tensions might also limit gold’s gains.

Gold Price Forecast for 2025

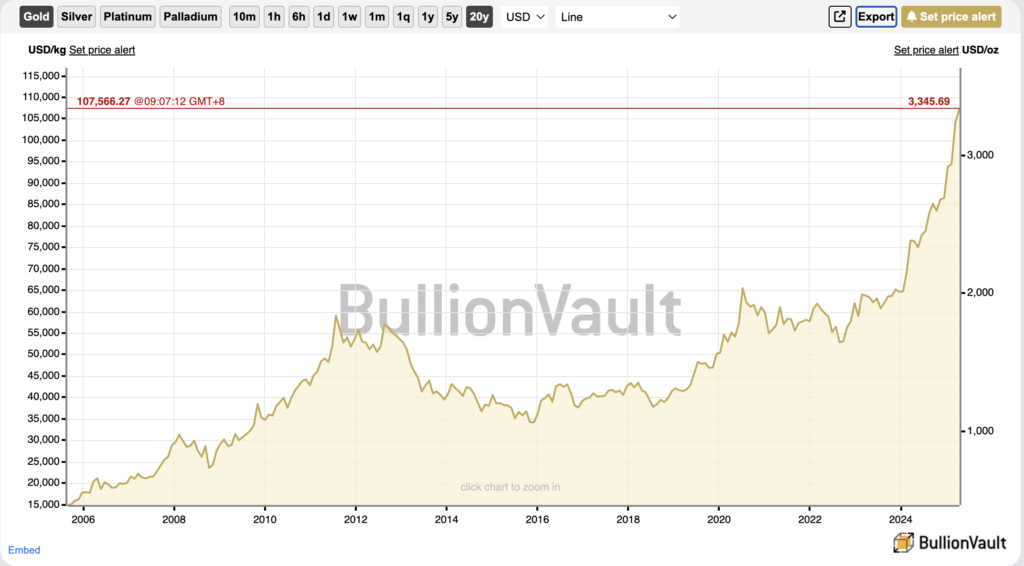

Based on expert analyses from firms like Goldman Sachs and J.P. Morgan, gold is poised for growth in 2025. As of April 2025, gold trades around $3,354 per troy ounce. By year-end, prices are expected to range between $3,200 and $3,300.

This forecast reflects strong central bank buying, ongoing trade tensions, and low interest rates. However, if the U.S. economy outperforms or geopolitical risks fade, prices could dip toward $3,000. Conversely, an intensified U.S.-China trade war could push prices closer to $3,500. Analysts see moderate upside, balancing these risks and opportunities.

Looking Ahead: 2026 and 2027

While 2025 is the focus, gold’s trajectory extends further:

- End of 2026: Prices could reach $3,500–$3,800, driven by sustained trade frictions and inflation concerns. A global recovery might cap gains, while a debt crisis could push prices higher.

- End of 2027: Expect prices between $4,200–$4,500, assuming steady demand and economic uncertainty. A stronger dollar could limit gains, but a financial crisis might propel prices toward $5,000.

Gold prices are sensitive to surprises. Key factors to monitor include:

- U.S.-China Trade: Escalating tariffs could spike demand.

- Inflation and Rates: Higher inflation or lower rates favor gold; Fed tightening could hurt.

- Geopolitical Events: New conflicts or trade disputes will boost gold’s appeal.

- Central Bank Moves: Continued gold purchases, especially by China, will support prices.

Conclusion:

Gold is set to shine in 2025, with prices likely to hover around $3,200–$3,300 by year-end. Trade tensions, low interest rates, and central bank buying create a favorable backdrop, though a stronger economy or calmer geopolitics could temper gains. For investors, gold offers a reliable hedge in an era of AI-driven change and global uncertainty. Keep an eye on economic shifts to stay ahead in this dynamic market.

Disclaimer: These predictions are based on trends and forecasts as of April 2025. Gold prices are volatile, and outcomes may vary. Always do your own research before investing.