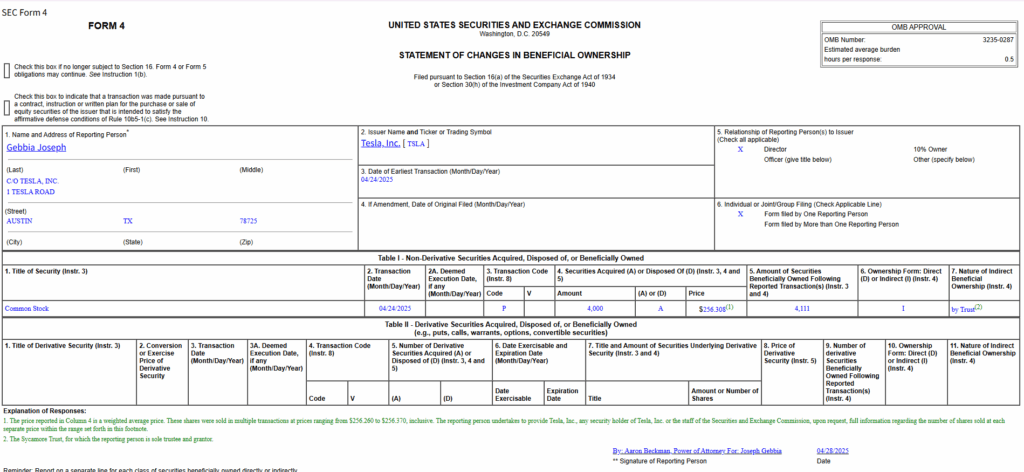

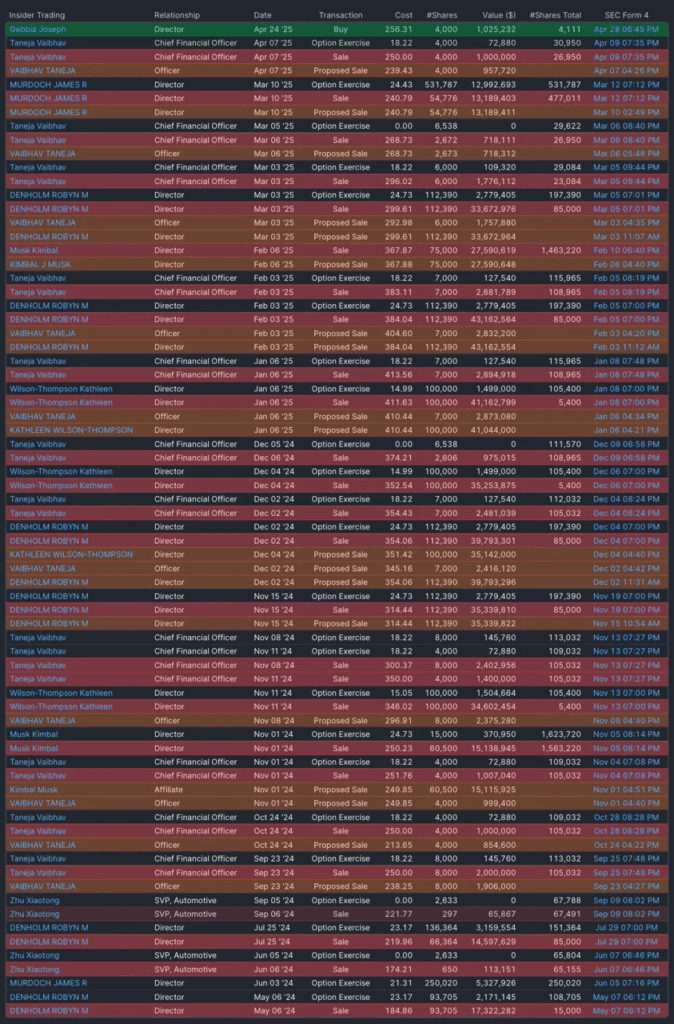

On April 24, 2025, Joe Gebbia, Tesla board member and Airbnb co-founder, made headlines by buying 4,000 Tesla shares at $256.308 each, totaling $1.025 million. This is the first insider purchase at Tesla in five years, breaking a trend of over $100 million in insider sales since early February. With Tesla’s stock down 40-50% from its December 2024 peak of $479.86, does Gebbia’s move signal a golden opportunity for long-term investors? Let’s break it down.

Why Gebbia’s Buy Matters?

Insider purchases often hint at confidence in a company’s future, and Gebbia’s buy is no exception. After a rough Q1 2025—marked by a 13% drop in deliveries, a 50% sales decline in Europe, and a 49% drop in China—Tesla’s stock has taken a beating. Gebbia’s investment suggests he sees the current price (around $285.88 as of April 25) as undervalued, possibly banking on Tesla’s long-term bets: autonomous driving, robotics (Optimus), and energy storage (Megapack). Retail investors are buzzing too, pouring $7.3 billion into Tesla over recent weeks, with some on X calling this a turning point.

But hold the hype. Tesla faces real challenges:

- Brand Backlash: Elon Musk’s political role in the Department of Government Efficiency (DOGE) has turned Tesla into a “political symbol,” driving boycotts and hurting sales.

- Competition: Chinese EV makers like BYD are outpacing Tesla with faster-charging tech and lower prices.

- Insider Selling: Other Tesla insiders, like Kimbal Musk, sold $27 million in stock recently, sending mixed signals.

- Valuation Risks: Even after the drop, Tesla’s $752 billion market cap demands strong future growth to justify.

Analysts like JPMorgan have slashed price targets, citing unprecedented brand damage, and short sellers have pocketed $16 billion betting against Tesla this year.

Should You Buy Tesla for the Long Term?

Gebbia’s purchase is a bullish signal, but it’s not a green light to dive in blindly. Here’s what to consider:

- Bull Case: If Tesla delivers on full self-driving, robotics, or energy, today’s price could be a steal. Gebbia’s buy and retail enthusiasm back this view.

- Bear Case: Sales declines, Musk’s distractions (SpaceX, xAI, DOGE), and global competition could keep Tesla volatile.

- Your Move: Align any investment with your risk tolerance. Tesla is high-risk, high-reward—perfect for some, not for all.

Final Thoughts

Gebbia’s $1 million bet is a spark of optimism for Tesla, but it’s just one piece of the puzzle. Long-term investors should dig into Tesla’s Q1 earnings, track Musk’s focus, and weigh the risks of its premium valuation. If you believe in Tesla’s vision, this dip could be an entry point. If you’re cautious, waiting for sales recovery or self-driving progress might be smarter.

What do you think—does Gebbia’s buy make you bullish on Tesla, or are the risks too high? Drop your thoughts below, and let’s discuss!

Disclaimer: This is not financial advice. Always do your own research or consult a financial advisor before investing.